Sometimes Blogger does the most infuriating things to me. And there really isn't much I can do to fix it at the moment.

At the moment, I have an expandable post hack in most (but not all) of my posts which is supposed to allow readers to click on the link "There's more of this diatribe here..." which should, theoretically, allow people to expand a post if they want to read more of it. It ain't working folks. If it pops up in this post (I didn't put it there) you'll need to click on the post heading to see more of the post instead.

It is driving me nuts. Don't know when I can fix it either, 'cause our net connection at home is not happening due to us changing ISPs.

Edit 17/07/2007: Thanks to this fix at Hackosphere, all is good again. I feel better now.

16 July 2007

08 July 2007

Great debacles of our time: The great mezzanine financing collapse (part 3)

This is part 3

Part 1 is here.

Part 2 is here.

It is with great displeasure that I announce that Bridgecorp has gone under.

This, sadly, means that a fourth major mezzanine financier has gone to the wall, and appears to have taken with it about AUD $25 million of investors' money.

I don't really want to add much more to this. It's a sad tale, and I don't know much about Bridgecorp's circumstances. Suffice to say, there can't be much more carnage on this front.

Standard but necessary disclaimer: This is not advice. Only a complete idiot would think that any of this constituted advice. It's not even vaguely reasonable to consider this to be advice. If you are in any doubt as to the content of this, see a good, independent financial adviser immediately. They do exist.

Part 1 is here.

Part 2 is here.

It is with great displeasure that I announce that Bridgecorp has gone under.

This, sadly, means that a fourth major mezzanine financier has gone to the wall, and appears to have taken with it about AUD $25 million of investors' money.

I don't really want to add much more to this. It's a sad tale, and I don't know much about Bridgecorp's circumstances. Suffice to say, there can't be much more carnage on this front.

Standard but necessary disclaimer: This is not advice. Only a complete idiot would think that any of this constituted advice. It's not even vaguely reasonable to consider this to be advice. If you are in any doubt as to the content of this, see a good, independent financial adviser immediately. They do exist.

07 July 2007

04 July 2007

Pants!

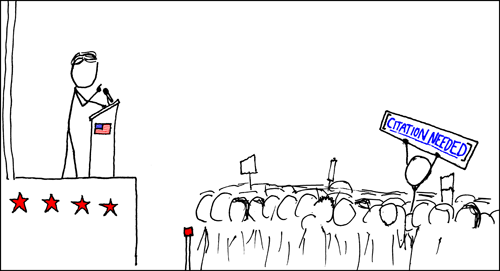

In what is getting my vote as the silliest lawsuit ever, good sense has prevailed in the District of Columbia and a plaintiff has lost a case against a dry-cleaner.

The plaintiff in this case was no ordinary plaintiff, though. In this case, Judge Roy L Pearson, Jr attempted to

During the case, the plaintiff was portrayed as a "bitter, insolvent man" who was solely motivated by greed. The defence clearly got that one right.

Pearson lost.

I've said on many occasions that tort law is sorely in need of reform. The one thing about torts is that it is one incredibly subjective area of the law, and the whole common law thing about it has proven to be time and time again, simply wrong.

Now, in Australia (as in most places around the world), we hear cases like this go on in US courts all the time and we say that it could only happen there.

Wrong.

Australia started getting a wave of stupid and silly lawsuits in the nineties as a result of pushy plaintiff lawyers proving that tort law is yet another weapon for greedy miscreants who just want to benefit at the expense of other people, and certainly not in a just fashion.

I once listened agog as a friend of mine with a background in litigation reeled off a string of precedents that would provide you with a fair chance to sue the roads authority for not keeping the road dry.

I've long held that some kind of legislation should be enacted explaining exactly what it is that can and can't sue someone for. And how to calculate the penalties.

In the early noughties, a wrestler at a gym in Melbourne (Foscolos v Footscray Youth Club and Parker, [2002] VSC 148) sued his trainer (and the gym) for over AUD 5.7 million and won, bankrupting the trainer. The grounds that Justice Bongiorno gave in this case were loss of future earnings.

Having a background in financial planning, I quickly did the mathematics and worked out that, based on our learned justice's calculations, every single financial planner in Australia was recommending serious under-insurance in the disability insurance area. By a factor of 75% of the kinds of figures that Bongiorno was coming up with.

That's some serious under-insurance.

Never mind what cases like this one do to legal liability insurance premiums.

Anyway, maybe now, after the Pearson case, common sense will prevail in this area of the law that has gotten completely out of hand.

And I would like to thank the judge in this case for awarding against Pearson, who must have been sniffing his undies when he dreamt up this ridiculous case.

I'd also like to call on the District Attorney for DC to prosecute Pearson for contempt of court. Clearly, this was an abuse of process and of the court itself. Especially since Pearson would have been well aware of this.

Subscribe to:

Comments (Atom)